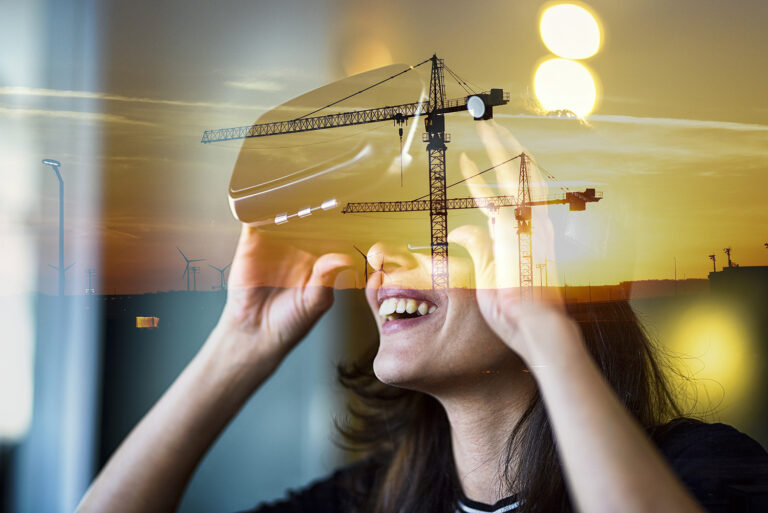

Private equity firms have historically avoided investments in the construction industry, likely due to its reputation as a seasonal, market-specific enterprise with little cash flow and large amounts of debt. However, the last few years have seen a noticeable uptick in the presence of private equity investors in construction. Advancements in technology, virtual reality, and robotics have led to greater operational efficiencies in construction, fueling the demand for new projects and creating ample opportunities for investors seeking new revenue. This has led to a steep increase in the need for sureties and bonding agencies to jump on the trend. With the relationship between private equity and construction already well underway, what role will sureties and bonding agencies play?

Advantages of Private Equity in Construction

With private equity firms now turning an eye to the construction industry as a viable and attractive outlet for investment, what are some of the benefits construction firms may experience from this influx of money? Here are a few of the ways private equity firms are helping to advance the sector:

- Capital

Private equity infuses construction firms with solid financial backing to take on more ambitious projects, acquire better equipment, and even penetrate new markets. An influx of cash gives companies, especially those struggling to raise funds on their own, a much-needed chance to reach their full potential.

- Market Expansion and Networking

Private equity firms offer access to an extensive network of investors and related businesses, aiding everything from leveraging strategic partnerships with suppliers to collaborating with subcontractors and breaking into new geographical areas.

- Operational Efficiency and Scale

Private equity investors operate with the goal of improving the partner business’s performance. Thus, they are highly skilled at identifying opportunities to streamline and optimize business operations, such as standardizing procedures, operational best practices, resource allocation, cost reduction, and enhancing overall productivity. They may also be a resource for navigating necessary digital transformations and software programs.

- Industry Expertise

Construction-centric private equity firms provide the latest industry expertise in identifying market trends, assessing growth opportunities, mergers and acquisitions, managing risks, and navigating regulatory challenges.

- Exit Strategies

With expertise in managing change, private equity firms offer construction companies the chance to navigate succession plans with confidence and forward momentum.

Surety Bonds: Their Role and Their Challenges

From growth and capital to technological advancements and succession planning, private equity provides numerous advantages for construction companies. Surety bonds can play a significant role in attracting new investments and collaborating within existing partnerships, specifically by offering financial guarantees and risk management to enhance the appeal of construction projects as investment opportunities. However, securing a bond in the private equity space is not always simple and does carry the weight of potential challenges.

Underwriting concerns

Surety companies conduct a thorough underwriting process to assess the risk associated with issuing bonds. This process involves evaluating the company’s financial stability, creditworthiness, project experience, and capacity to fulfill its contractual obligations. The underwriting process for private equity-backed construction businesses will generally be the same as for any other account; however, when private equity is involved, certain questions should be asked to ensure the relationship is financially reasonable for all parties:

- Will expected growth cover the new debt service?

- How will the construction firm be managed under the new ownership, and is there enough management depth?

- How will the shareholder’s future earn-outs, if any, impact the company’s future financial performance?

It’s worth noting that the end goal for the private equity firm may not always be clear. In fact, it’s safe to expect a certain lack of transparency from the firm when requesting this kind of information. The goal is to identify how the private equity firm intends to evolve with the company and gain insight into the overall dynamic of the relationship.

Challenges with contracts and agreements

Like any surety bond, assessing the risks before issuing any financial assurances is critical. Although normally the backbone of the surety cycle, personal indemnification agreements are a rarity when working with private equity. This poses a unique situation that many sureties may find challenging. With indemnification agreements likely off the table, what other options are available in its place?

- Access to collateral will be paramount in replacing indemnification agreements, with the three most common and widely accepted forms of collateral being irrevocable letters of credit, certificates of deposit, and fixed assets.

- Intercreditor agreements are another necessary legality when multiple funders are involved. Serving as a contract between common leaders (including a surety), and an intercreditor agreement outlines the terms and the collateral allocation should the borrower default. Codifying this understanding is highly beneficial in helping subordinate lenders and sureties protect their rights and interests within the agreement. In general, the agreements will include provisions for seniority, payment priority, subordination, dispute resolution, information sharing, and other rights and remedies in the case of borrower default.

Resource Knowledge About Private Equity in Construction If you’re interested in learning more about the relationship between private equity investors and the construction industry or want to learn more about how surety agencies can collaborate within the industry, we are here to help. Contact ARB today if you have any questions or want to discuss your company’s tax, accounting, and business advisory needs.

David Jean is the Practice Leader of the Construction & Real Estate, Business Advisory, and Succession Planning Services Teams. He focuses primarily on financial accounting and consulting for construction, real estate, and manufacturing companies. He is a Certified Construction Industry Financial Professional (CCIFP) and board member and past chairman of the Associated Builders and Contractors of Maine.