Auto Dealership

ARB has worked with auto dealerships throughout New England for more than 45 years. We invest significant time in training and continuous learning for our team at all levels, so we understand the industry, its sensitivity to economic fluctuations, and the unique reporting, accounting, and operational needs of auto dealerships. Dealerships are our passion – whether single-points or dealer groups!

How We Do It

ARB is a full-service certified public accounting and business consulting firm with a team of professionals who specialize in providing quality and timely services to auto dealerships. We are able to identify problems and offer savvy solutions to help improve the efficiency of your operations and increase profitability. We provide benchmarking analyses, financial statement and tax preparation, M&A services, and business valuations alongside a comprehensive suite of additional dealership-focused services.

Auto dealers have a high volume of high-value transactions each day, making employee theft tempting. We can help you review your internal controls to minimize the opportunity for fraud.

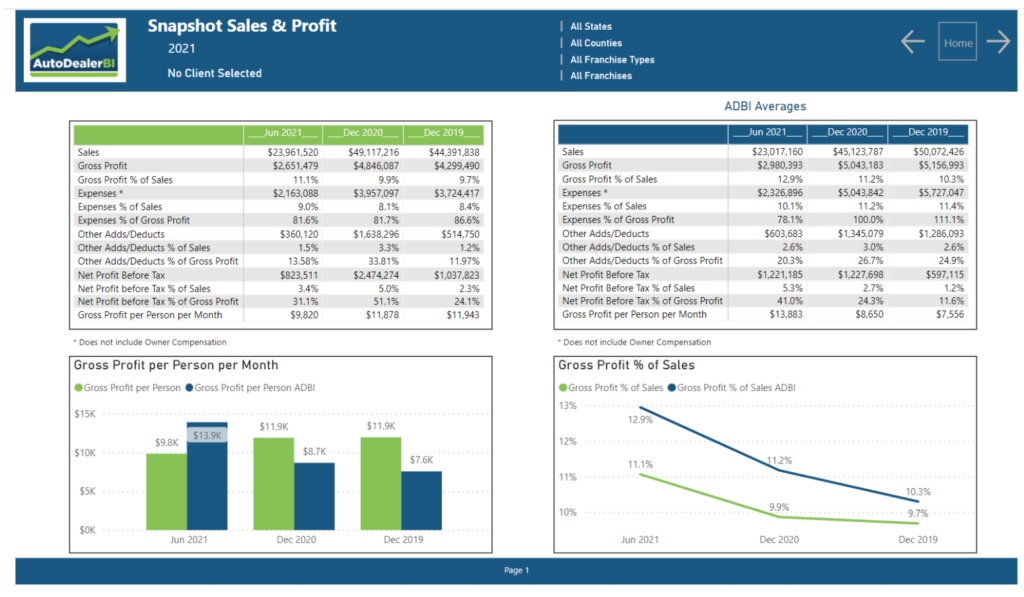

We can help you see what areas of the dealership were most profitable and what trendlines show over multiple years, including benchmarking for the industry.

We can perform a review of your dealership’s internal controls and financial records to help you prevent and detect fraud.

Auto dealerships frequently engage in M&A, so we have experience with helping both buyers and sellers with due diligence, tax planning, and post-deal accounting.

Resources for Auto Dealerships

Growth by Acquisition: Dealerships that want to grow by acquisition need skilled representation during each phase of the transaction. We want our clients to pay a fair price, perform sound due diligence, and successfully integrate the acquisition into their existing operations. This is what we do…and more!

Operational Reviews: ARB offers a unique perspective. Due to our extensive dealership relationships, we have a keen understanding of auto industry best practices. We regularly assess dealership processes and internal controls and assist our clients with designing a system that better protects their dealership’s assets and maximizes profits.

Team Training: Using our Dashboard report, we participate in client management meetings helping the dealership team to understand the numbers “from an accountant’s perspective.” During these meetings, we have an open dialogue with the dealership’s team about what they are doing well and where they can improve.

Professional Representation: Our dealership team has a reputation that is second to none with various lending institutions and other professionals in the automotive industry. We work closely with our clients to provide their other advisors and financial partners with information that is useful and timely.

Leveraging Tax Benefits: We help auto dealerships assess their eligibility and take advantage of tax benefits, such as the Section 179D deduction for qualified real estate holdings, 100% bonus depreciation, the R&D tax credit, and more. We also help dealership owners with tax savings strategies, such as aggregating dealership activities to increase their QBI (199a) deduction.

How We’re Helping Our Auto Dealership Clients

Auto Dealership Business Intelligence

Headlights Quarterly Newsletter

Keeping up with the many challenges and opportunities in the auto industry isn’t easy. That’s where Headlights comes in.

Auto Dealership Team Leaders

Barton D. Haag, CPA | ARB Principal

Auto Dealership Practice Leader

Bart joined ARB in 1996 and is a Principal with the firm. The growth of ARB’s Auto Dealership Group is a natural result of consistently anticipating the needs of dealerships and providing savvy, sensible, and customized services at fair prices.