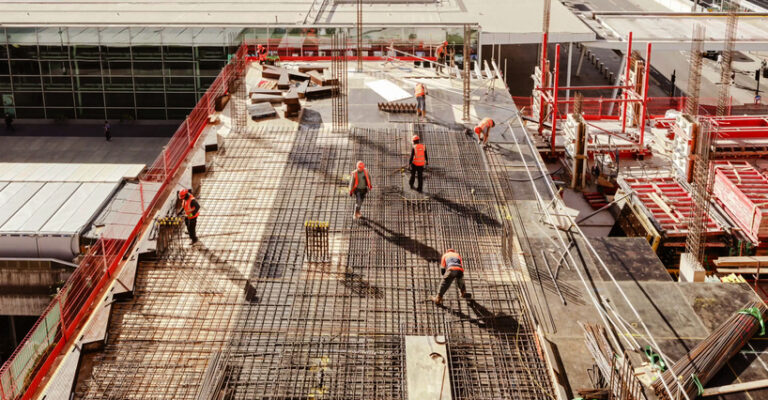

In the past, private equity firms tended to avoid investments in the construction industry, likely due to construction’s reputation as a seasonal, market-specific enterprise with little cash flow and large amounts of debt. But within the last few years, you may have noticed an upturn in private equity in construction companies.

Private equity is catching on to the increased demand for construction projects and taking note of how technological advancements in construction (such as building information modeling and robotics) present an opportunity for improvements in operational efficiency.

Clearly, investors are starting to realize construction’s potential for profit, but what does that mean for construction company owners? What are the advantages for construction companies thinking of partnering with a private equity firm?

Private equity provides construction with capital

Probably the greatest advantage of private equity in construction is access it brings to substantial capital resources. Private equity firms can infuse construction companies with the large amounts of capital needed to fund projects, buy advanced equipment, and improve operations.

You already know that construction firms with solid financial backing can take on more ambitious projects, acquire better equipment, and even penetrate new markets. An influx of cash can be a game-changer, giving companies who might otherwise be unable to raise funds the chance to reach their full potential.

Market expansion and networking

In addition to capital, private equity firms offer access to an extensive network of investors and related businesses. They can facilitate industry connections that might be impossible to achieve as an individual. From leveraging strategic partnerships with suppliers to collaborating with subcontractors and breaking into new geographical areas, private equity connections may help a business grow its sales pipeline.

Operational efficiency and scale

Most private equity investors operate with the goal of improving the performance of the partner business. For this reason, private equity is highly skilled at identifying opportunities to streamline and optimize business operations.

With the help of a private equity firm, construction companies can improve processes they have probably been too busy or too understaffed to address. Private equity can help with big tasks such as standardizing procedures, operational best practices, resource allocation, cost reduction and how to enhance overall productivity.

In an age where digital transformation is less of a luxury and more of a necessity, construction companies can also look to private equity as a resource for selecting and implementing new software programs. Of special interest might be software for all stages of project management (including supply chain management) and software that facilitates attracting and training top talent. Without digital improvements, many companies will find themselves struggling to remain competitive in a quickly changing market.

Industry expertise

Certain private equity firms specialize in the construction sector. These firms bring industry-specific knowledge and expertise to the playing field, which can have a huge impact on growth. Imagine getting access to the latest expertise in identifying market trends, assessing growth opportunities, managing risks, and navigating regulatory challenges. Mergers and acquisitions may also come into play when dealing with private equity firms that specialize in construction.

Enhanced exit strategies

If you’re like many business owners today, you simply don’t have an exit plan in place. But when private equity firms enter the picture, they can pave the way for you to wind down your role in the company without closing your doors. A private equity firm can ensure a smooth transition of leadership and ownership when it’s time to transition. Investors can help companies develop future leadership within the organization and create plans that identify key positions and talent gaps, and address labor retention strategies. With expertise in managing change, private equity firms offer construction companies the chance to navigate succession plans with confidence and forward momentum.

Resource Knowledgeable About Private Equity in Construction

If you’re interested in ways to make your company more appealing to private equity investors, ARB’s Construction Advisory Services Team is dedicated to helping contractors maximize both the financial and operational aspects of your business. We stay up-to-date on construction technology trends and other issues affecting your industry. We provide industry-specialized accounting, tax, and advisory services for construction start-ups, established firms, and the contractors that own them. Contact us today if you have any questions or would like to discuss your company’s tax, accounting, and business advisory needs.

by David Jean, CPA, CCIFP, CExP

David Jean is the Director of Altus Exit Strategies and a Principal at Albin, Randall & Bennett, where he is also the Practice Leader of the Succession Planning, Business Advisory, and Construction & Real Estate Services Teams. David works with business owners who want to improve their business’s value before they sell through the Seven-Step Exit Planning Preparation™ process. He has worked with companies from $5 million to $50 million in revenue across a range of industries.