Blog | Albin Randall & Bennett

Recent Articles

Over-Saving for Retirement: Avoiding Unexpected Penalties and Embracing Opportunities

Saving for retirement is essential to ensuring financial security, but focusing too heavily on retirement accounts can have unintended consequences. While it may seem counterintuitive,

Life as an ARB Accountant During Busy Season

Considering a career in public accounting? You may have a lot of questions about what the work actually involves—especially during “Busy Season.” How do accountants

Thriving Independently: A Credit Union’s Guide to Sustainable Growth

The credit union industry has experienced a wave of mergers in recent years, often driven by unprecedented growth, economic pressures, regulatory challenges, or member attrition.

Depreciation Made Simple: Bonus, Section 179, MACRS, and Straight-Line Explained

When you buy a heavy vehicle for your business, choosing the right depreciation method can significantly impact your taxes. Depreciation methods not only influence your

Maine Employers: Certified Private Plan Options Now Available for Paid Family and Medical Leave

Maine’s Paid Family and Medical Leave (PFML) program has certified 12 insurance policies for use as private plan substitutions. For Maine employers considering alternatives to

TCJA Expiration: Seven Ways U.S. Manufacturers Will Be Affected and How to Prepare

Since the enactment of the Tax Cuts and Jobs Act (TCJA) in 2017, U.S. manufacturers have experienced significant economic growth. The law lowered corporate tax

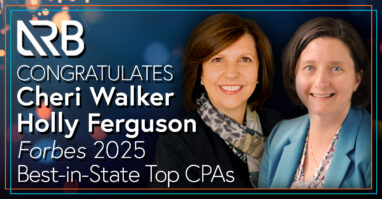

Cheri Walker and Holly Ferguson Named to Forbes 2025 Best-in-State Top CPAs List

Albin, Randall & Bennett is proud to announce that Cheri Walker and Holly Ferguson have been named to the Forbes 2025 Best-in-State Top CPAs list.

Is CRM Software for Construction Companies, Too?

Originally published in On-Site, ARB’s Construction Industry newsletter. In technological parlance, “digital transformation” refers to many businesses’ ongoing efforts to digitalize all their processes. One

Business Success: The Power of Dreaming

Dreaming is often the foundation of creating your ideal reality. For many business owners, their success started with a simple dream: “What if I could

Considering the Cost Savings of Mobile Field Fueling

Originally published in On-Site, ARB’s Construction Industry newsletter. Keeping construction vehicles and equipment fueled up has always been a challenge. Customarily, contractors transport vehicles and

Why Busy Contractors Should Consider Benchmarking

Originally published in On-Site, ARB’s Construction Industry newsletter. If you’re like most busy construction business owners, you have plenty on your plate. Adding anything more