Blog | Albin Randall & Bennett

Recent Articles

MANP Issues Guidelines for Safely Reopening Nonprofit Organizations in Maine

All sectors of business in Maine have been affected by the COVID-19 crisis, and nonprofits are definitely no exception. As our communities, businesses, and organizations

Tax Planning for 2020, A Pandemic Year

This year is already turning out to be a unique one, in terms of its uncertainty associated with the COVID-19 pandemic. It seems like so

Qualified Improvement Property –Error Fixed!

The CARES Act was passed in late March, largely to provide stimulus and emergency assistance to individuals and businesses adversely impacted by the coronavirus pandemic.

FASB Issues ASU Delaying Effective Date for Revenue Recognition & Lease Accounting Standards for Certain Entities

The COVID-19 pandemic has significantly impacted the global economy, and U.S. businesses are no exception. On June 3, 2020, the Financial Accounting Standards Board (FASB)

Senate Passes Bill Granting Flexibility to PPP Borrowers

The senate passed the House bill last night to change the PPP loan program. It appears they passed the house version “as is” in order to avoid

Unemployment Fraud Investigations Are Underway: Potential Delays in Receipt of Benefits May Be Ahead

The COVID-19 pandemic has been a time of uncertainty and vulnerability for millions of Americans. As our nation’s unemployment rate continues to rise due to

COVIDTRA for Businesses & Nonprofits: A Closer Look at Certain COVID-19-Related Tax Relief

On December 27th, President Trump signed the COVID-Related Tax Relief Act (COVIDTRA), a $908 billion relief package, into law. Among other provisions, the legislation includes

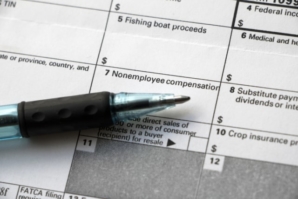

Form 1099-NEC & the IRS’s New Nonemployee Compensation Reporting Requirements

Beginning with 2020 information reporting, the IRS is reintroducing Form 1099-NEC, a form that was previously used until the early 80’s for reporting nonemployee compensation.

What Employers Need to Know About The CARES Act Payroll Tax Deferral

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) contained a provision allowing employers to defer payment of their required 6.2% portion of

COVIDTRA for Individuals: A Closer Look at Certain COVID-19-Related Tax Relief

On December 27th, President Trump signed the COVID-Related Tax Relief Act (COVIDTRA), a $908 billion coronavirus relief package, into law. Among other provisions, the legislation

ARB Holiday Hoopla

ARB’s Annual Holiday Party, Virtual Edition On Friday, December 18, ARB held our annual holiday party – this time via zoom! Featuring a surprise showing