Blog | Albin Randall & Bennett

Recent Articles

The CARES Act for Nonprofits

This past couple of weeks, we’ve shared a lot of information about the three recently passed pieces of legislation that are the direct result of

CARES Act Establishes Paycheck Protection Program

On Friday, March 27, 2020, President Trump signed the $2.2 trillion spending bill, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), into law,

The SBA’s EIDL Program: Additional Business Assistance for COVID-19

The enactment of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) commences Phase III of the economic stimulus plan created to swiftly provide

Impact of Federal Government Coronavirus Response on Businesses

We’ve been very busy working with clients over the past several weeks helping them navigate and prioritize the various pieces of new legislation passed to

CARES Act Enacted: What’s Next?

In the midst of the COVID-19 crisis, many Americans are already experiencing economic hardship on account of the pandemic. Some are out of work or

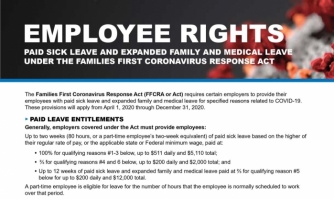

Families First Act DOL Posters

The DOL has issued a couple of useful links on its website. The first is regarding posters required that must be hung in the workplace and any other

SBA Issues PPP Loan Necessity Questionnaires to Borrowers of $2M or More

The Small Business Administration (SBA) has developed two questionnaires, one for nonprofit borrowers and one for for-profit business borrowers, that will go to Paycheck Protection

SBA Issues Procedural Notice Addressing Changes of Entity Ownership for Paycheck Protection Program Loan Recipients

On October 2nd, the SBA issued a procedural notice addressing the banking procedures involved in changes of entity ownership for Paycheck Protection Program (PPP) loan

ARB Announces Fall Promotions

Albin, Randall & Bennett is excited to announce 11 employee promotions! ARB congratulates Robin Cyr, Benjamin Lord, Samantha Pedersen, Gisèle Couturier, Amy Gardella, Jennifer Lemay,

2020 Tax Planning for Private Wealth, Closely Held Businesses, & Related Ventures

Tax planning for year-end 2020 will occur under very unique circumstances. COVID-19 has had an economic impact on all walks of life and industry sectors,

The CARES Act: A Closer Look at Certain Provisions for Manufacturers

Manufacturers have a lot on their minds, from maintaining operations and adapting business models to navigating supply chain and workforce issues. The CARES Act was