Labor burden rate

ENSURE BIDS ACCOUNT FOR THIS CRITICAL METRIC

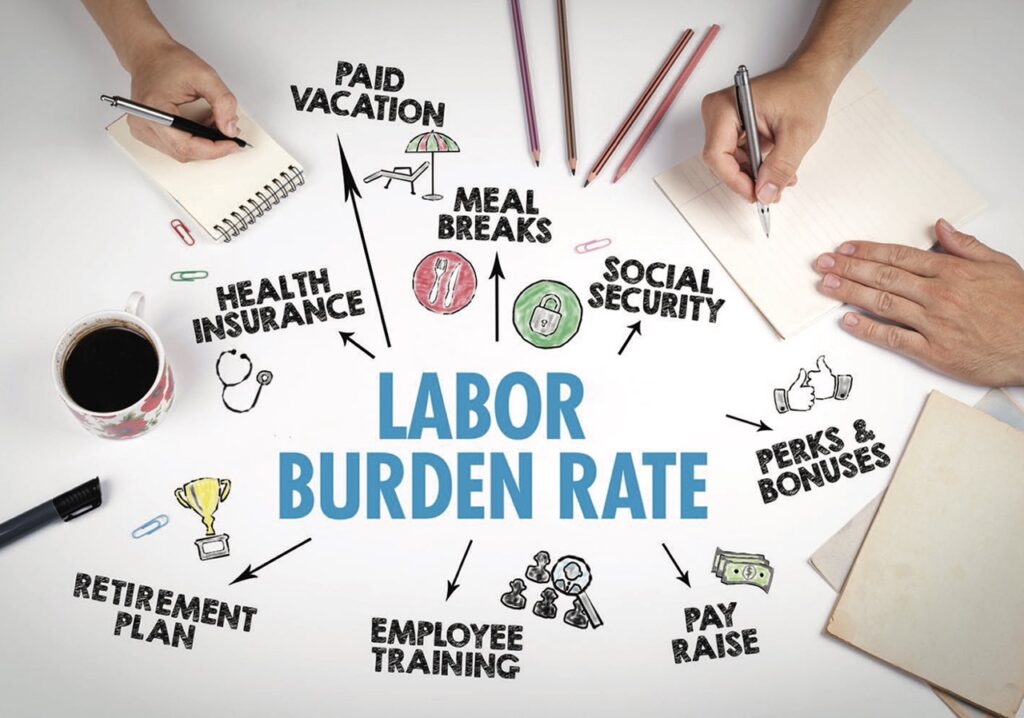

Along with just about everything else, labor costs are on the rise in the con- struction industry. This makes it more important than ever to accurately estimate such costs when bidding on new projects. If you’re not properly calculating and incorporating labor burden rate — essentially, the indirect costs of having workers — you may very well be selling yourself short.

What’s it all about?

Labor burden rate recognizes that wages aren’t the only costs you incur to employ workers. It expresses your total indirect labor costs as a percentage of your total direct labor costs. So, for every dollar of direct labor you allocate to a project, you should also apply the labor burden as a percentage of that dollar to ensure you’re capturing all labor costs.

To calculate labor burden rate, you divide indirect labor costs by direct payroll costs. You can then use the rate as follows to determine the total labor cost of the crew you’d use on a project:

Total direct payroll cost + (total direct payroll cost × labor burden rate) = total labor cost

When totaling indirect labor costs, take care to include all indirect costs related to employing your workers that you can’t allocate to specific projects. At minimum, these will typically include payroll taxes: 6.2% for Social Security, 1.45% for Medicare and 6% for federal unemployment, plus state unemployment taxes where applicable. Employee benefits should also be factored in. These may include:

- Health, dental and vision plans,

- Life insurance and disability insurance for employees,

- Bonuses or profit sharing,

- Retirement plans,

- Tuition reimbursement or student loan debt assistance, and

- Paid time off.

Insurance for your construc- tion company is also usually included in indirect costs. In terms of labor burden rate, the costs of your workers’ compensation policy would be relevant to include in the calculation.

In addition, be sure to allo- cate safety and compliance costs (for example, personal protective equipment) and communication costs (for instance, the purchase of and maintenance and repairs to smartphones and tablets). The costs of small tools and supplies, as well as training costs and cer- tain administrative overhead, can also be allocable as indirect labor costs.

Why does it matter?

Construction businesses devote copious time and resources to pricing out jobs with the goal of max- imizing profitability. Yet if you don’t include labor burden rate as part of the process, you may be undermining that objective. After all, labor burden costs generally run from 30% to as high as 75% (for union workers) of direct payroll costs.

Tracking labor burden rate over time can help you improve the accuracy of estimates and provide a more detailed picture of project costs.

And these costs can sneak up on you. For example, given the ongoing skilled labor shortage, many construction companies have had to expand employee benefits and paid time off to recruit and retain workers. Also, to get new hires up to speed and to adjust to industry tech changes, you may be providing more training than in the past. These are just a couple of easily overlooked factors that could gradually drive up your labor burden rate, threatening the bottom line.

Tracking labor burden rate over time can help you improve the accuracy of your estimates and provide a more detailed picture of each project’s actual costs. Plus, doing so can lead to more informed decision making about, for instance, whether to use subcontractors or employees and when layoffs might be necessary.

Moreover, when you have a fuller grasp of the cost to employ a worker, you can forecast and budget better — not only for specific projects, but also for the company overall. As a result, you’ll have a better understanding of your financial standing, both currently and in the future.

Who can help?

With so many cost components involved, calculating labor burden rate clearly isn’t a one-time

thing. Generally, you should recalculate it at least every six months or whenever you experience

a substantial cost hike in any of the areas mentioned. Be particularly wary of cost increases that will likely kick in when work is scheduled to begin on a job for which you have or will submit a bid. Your CPA can help you identify all the cost com- ponents relevant to your construction business and assist you in performing accurate calculations.

DON’T OVERLOOK INVENTORY BURDEN RATE EITHER

Labor burden rate (see main article) may not be the only such figure you need to track carefully. Some construction businesses also need to know their burden rates for any inventory they manufacture, store and distribute. In fact, under Generally Accepted Accounting Principles, balance sheet figures for inventory must include an inventory burden rate.

Like labor burden rate, inventory burden rate considers a variety of indirect costs, including those related to:

- Materials,

- Stocking and storage,

- Operating machinery,

- Facilities, and

- Equipment.

The rate is calculated by dividing such “overhead” costs by a so-called “activity measure.” The measure typically is either the amount of machine time used to produce an item or the amount of the related direct labor cost.

For example, if overhead is $20,000 and 2,000 hours of machine time were used to manufacture an inventory item, the burden rate would be $10 per machine hour. This figure can then be added to the direct materials and labor costs for the item to calculate its total cost.

CROSSING STATE LINES? BRUSH UP ON SALES AND USE TAXES

For construction businesses that venture to other states for work, managing sales and use taxes can be challenging. Generally, you’re treated as the consumer of materials that you use on your jobs. Thus, either you pay sales tax to your vendors or, for out-of-state vendors that don’t collect sales tax, you self-assess use tax and remit it to the state. You probably don’t typically collect sales tax from the owners you contract with.

As with most general rules, however, there are exceptions. And that’s why, if your company could cross state lines to work on a project, it’s better to be safe — that is, well-informed — than sorry.

Various complexities

Some states treat contractors as retailers of certain materials. In such cases, you buy the materials tax-free under a resale exemption and collect sales tax from the owner. Examples might include appliances, window treatments, window-mounted air conditioning units, carpeting, and certain business fixtures treated as personal rather than real property.

A few states impose sales tax on specified construction services, requiring contractors to pay sales tax on their materials and collect sales tax from customers. Meanwhile, in other states, the sales tax treatment depends on the contract type.

With a lump-sum contract, for example, the state treats the construction company as the consumer of materials incorporated into the real estate. However, with time and materials contracts, in which charges for materials are itemized separately from labor and other charges, the state views the construction business as a retailer. This allows the builder to buy materials tax-free for resale but requires it to collect sales tax from the owner.

Another complexity involves sales tax exemptions. In many states, certain types of entities — such as schools, hospitals, and nonprofits — are exempt from sales tax. In some of these states, the exemption “flows through” to the construction business. That means the contractor can buy materials tax-free under an exemption certificate for use on a project involving an eligible entity. However, in other states, the exemption is available only if the entity itself buys the materials.

It’s all about nexus

Historically, states were limited to imposing sales tax collection obligations on sellers that had a physical presence in the state. However, following the U.S. Supreme Court’s 2018 decision in South Dakota v. Wayfair, states may require out-of-state sellers to collect and remit sales tax if a seller has an “economic nexus” with the state. And indeed, most states have enacted economic nexus laws.

Therefore, it’s critical to understand the sales and use tax rules in the states where your construction company operates. Also be cognizant of local sales tax rules and regulations. As feasible, provide resale or exemption certificates to vendors — or have exempt owners buy materials directly, if necessary — to take advantage of available sales tax exemptions.

Finally, investigate how the contract types that your business usually operates under affect your sales and use tax obligations. Consider those obligations when developing bids.

An audit may help

If your construction business regularly buys materials, supplies, equipment, and other items in multiple states, consider conducting a reverse sales-and-use tax audit.

You might be familiar with sales-and-use tax audits conducted by state or local authorities. The purpose of these audits is to uncover purchases for which sales and use taxes were improperly collected and remitted to the state. A reverse audit does the opposite: It examines the sales and use taxes your company has paid and identifies overpayments for which you can claim a refund.

Often, these overpayments involve taxes paid on purchases that were eligible for an exemption. Generally, it’s the purchaser’s obligation to claim an exemption, so mistakes are common.

An enticing prospect

As construction markets change, and particularly with many federally funded infrastructure jobs coming online, the prospect of working across state lines may become more enticing. If you decide to hit the road, work with your CPA to ensure you’re fully aware of all the tax ramifications.

5 TIPS FOR A SMOOTHER SURETY EXPERIENCE

To work on projects of a certain size or type, a construction business may need to be bonded. A surety bond is a legally binding contract among the contractor, a surety, and the project owner that guarantees the construction company will fulfill its obligations under the contract. Should it fail to do so, the surety assumes liability.

If your construction business finds itself in need of a bond to work on a given job, here are five tips for a smoother surety experience:

- Start with a broker. Just as they do when buying insurance, many contractors use a broker to help them find a surety. This professional will help you identify a provider that best meets your needs and has the necessary coverage capacity. (Sureties have caps on the maximum coverage they can offer.) Naturally, you should choose a broker who has experience in the construction industry and understands your company’s mission and services. Also look for involvement in relevant trade associations and references from businesses like yours. As the broker brings you prospective sureties to consider, apply the same type of scrutiny that you’d give any insurer. Make sure the firm is familiar with your type of construction contracts and is licensed and authorized to issue bonds in the states where you work. A surety should have an A rating or higher from AM Best or an equivalent rating from a respected credit rating organization, such as Dun & Bradstreet.

- Carefully prepare the required documentation. After engaging a surety, you’ll likely undergo a prequalification process. Be prepared to provide an organizational chart, business and continuity plans, financial statements, bios of leadership and other key personnel, project/work history, references, and statements of any lines of credit. The more detailed and accurate the information, the better.

- Double-down on meticulous financial management. Sureties are absolutely interested in a list of satisfied clients and a track record of completing jobs on time and within budget. However, they also want assurance that you can continue to run a financially stable company. Be prepared to show how you’ll maintain a strong cash flow and timely billing schedule going forward. Address red flags such as underbillings and unapproved change orders. Underbillings may indicate poor billing practices, which can lead to sluggish cash flow. Meanwhile, unapproved change orders may indicate substandard project management processes that could inhibit you from getting paid on time — or at all.

- Maintain a solid relationship. Frequent, open communication is key to a good surety relation- ship. Promptly address concerns and provide project updates. Apprise your provider of any notable news regarding the business, such as ownership changes or expansion plans. A surety is more likely to maintain or even increase your bonding capacity if you’ve established a pattern of transparency and reliability.

- Mind “the three Cs.” As you work with a trusted surety, always keep in mind the three Cs of bonding: capital, character and capacity. Capital generally refers to having a healthy amount of working capital as well as strong cash flow and a solid credit history. Character is continually showing that you run an ethical business that provides quality workmanship. And capacity is maintaining the workforce, assets and other resources to complete projects as contracted.

FLYING HIGH WITH A DRONE WHILE STAYING GROUNDED ABOUT THE RISKS

If you checked out any “2023 construction trends” lists heading into the year, you probably saw “drones” on at least one of them. Technically called unmanned aerial vehicles (UAVs) or small unmanned aircraft systems (UAS), these remote-controlled devices have been flying high in construction recently — and for good reason.

Many purposes

Drones can do many things for contractors. Examples include:

- Collecting data safely and efficiently in hard-to-reach or dangerous areas,

- Being your “eyes in the sky” for monitoring work or strengthening security, and

- Capturing visuals to share with project stakeholders or for marketing purposes.

What’s more, drones are expected to take on an even larger role in construction thanks to recent improvements. Today’s models offer real-time aerial imagery and 3D lidar (Light Detection and Ranging) scans. They can also integrate with building informa- tion modeling software.

Issues to consider

Owning and operating a drone, however, involves costs and risks. Choose a model or third-party pro- vider based on your company’s specific needs. Investigate specifications such as payload capac- ity, flight time, range and camera resolution. Other features to look into include thermal cameras, obstacle avoidance, GPS tracking and automatic return to home. Also consider:

Licensing and regulations. You’ll need to register your drone with the Federal Aviation Administration (FAA) and comply with FAA regulations. For exam- ple, regs require drone operators to obtain a remote pilot certificate with a small UAS rating or be under direct supervision of a licensed operator. You also must follow operational guidelines that include flying below 400 feet and maintaining a constant line of sight with the drone.

Along with the FAA, your local government may regulate drone usage too. Commercial licensing,

registration and operational requirements tend to differ by jurisdiction.

Insurance and liability. Ensure that you have appropriate coverage for drone operations, as accidents or property damage may lead to liability claims. If your general liability insurance doesn’t cover drone usage, explore obtaining a separate drone-specific policy.

Data collection and processing. Drones can collect vast amounts of data, including high-resolution images that can be converted to topographic maps and 3D models. You’ll need to have the right software for processing, storing and analyzing this information.

Training and safety. Drone operators should be well-trained and follow all safety protocols. The most common risks associated with drone usage on construction sites include collisions, crashes and interference with other equipment. Regular inspections and maintenance of your drone can help prevent accidents.

An exciting addition

Whether you call it a drone, a UAV or UAS, one of these assets can be an exciting addition to your equipment inventory. Just be sure to shop carefully and, as ever and always, put safety first.