The senate passed the House bill last night to change the PPP loan program. It appears they passed the house version “as is” in order to avoid delays going to conference to reconcile. The bill has now been sent to the President for his signature. As always, we will keep you informed as additional information becomes available.

We will update our PPP Loan Forgiveness Workbook for these changes once the President signs the bill into law. As with the original version, the updated workbook will be a useful planning tool to do “if, then” analysis regarding your headcount and payroll costs.

Below are the significant changes in the Bill:

1. The minimum loan maturity would be 5 years and the maximum 10 years for all new loans. Loans are currently set at 2 year maturities. Borrowers and lenders can mutually agree to modify the maturity of existing loans.

2. The Covered period for applying for loans would be extended to December 31, 2020. Currently, the covered period for applying for loans ends June 30, 2020.

3. The 8-week covered period for spending loan funds would be extended to 24 weeks from the date loans are funded or December 31, 2020, whichever comes first.

4. The safe-harbor or rehire provisions would be extended to December 31, 2020. They are currently on or before June 30, 2020.

5. The Treasury added several exemptions for the FTE provisions for employees that terminated their employment for various reasons or reduced their hours. The Bill amends the law and adds the following additional exemptions to the FTE requirements:

- The borrower is unable to rehire an individual who was an employee on or before February 15, 2020; AND

- Is able to demonstrate an inability to hire similarly qualified employees on or before December 31, 2020; OR

- Is able to demonstrate an inability to return to the same level of business activity as such business was operating at prior to February 15, 2020.

6. The 75% rule is modified to indicate that 60% of the forgivable amount of a loan must be for payroll costs.

7. There is an exception allowing borrowers that received their loans prior to this Bill to elect to retain their original 8-week forgiveness covered period.

8. The deferral period for principal, interest or fees would be extended to the date the forgiven amount is remitted to the lender.

9. The date a borrower must apply for forgiveness is currently not defined. The Bill would require application for forgiveness within 10 months after the last day of the forgiveness covered period.

10. Lastly, the Bill restores eligibility of a borrower to get employer payroll tax deferral regardless of their PPP Loan forgiveness.

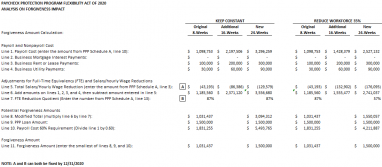

Many borrowers have been focused on what’s best for loan forgiveness instead of what’s best for their business. Perhaps it’s an unintended consequence, but it appears this bill better aligns those two objectives. Consider the following example:

As the above example indicates, depending on where you’re at during your 8-week period, you could reduce your workforce 35% TODAY and still get 100% forgiveness. Of course, the example isn’t perfect because the FTE reduction is based on an average and the compensation reduction is based on actual employees; however, it does demonstrate that significant cuts can be made to “right-size” your team and still get full forgiveness.

by Barton Haag, CPA